Hong Kong, due to its advantage of being an international financial centre, has attracted many family offices that manage assets for ultra-high net worth individuals (UHNWIs) to set up operations here. The HKSAR Government recently issued a policy statement on developing Hong Kong into a world-leading family office hub.

Christopher Hui

Active Policy Support to Leverage Multiple Advantages

Family office business needs are increasing amid the substantial rise in the number of UHNWIs in Asia and the wealth inheritance needs of the emerging new generation. According to a survey, Hong Kong was a city with a high concentration of UHNWIs in the world in the first half of 2022, with a total of over 15,000 people. Christopher Hui, Secretary for Financial Services and the Treasury, said: “Hong Kong, whose attractiveness goes far beyond its role as an investment and financing centre, can meet the needs of the emerging new generation of family decision-makers as they pursue positive impacts.”

Family office business needs are increasing amid the substantial rise in the number of UHNWIs in Asia and the wealth inheritance needs of the emerging new generation. According to a survey, Hong Kong was a city with a high concentration of UHNWIs in the world in the first half of 2022, with a total of over 15,000 people. Christopher Hui, Secretary for Financial Services and the Treasury, said: “Hong Kong, whose attractiveness goes far beyond its role as an investment and financing centre, can meet the needs of the emerging new generation of family decision-makers as they pursue positive impacts.”

Diverse advantages and full range of wealth management services

Singapore has been vying for the family office business in recent years. How can Hong Kong stand out from the competition? In Hui's view, Hong Kong is one of the most resilient economies in the world. “Under the ‘One Country, Two Systems' framework, the HKSAR retains its competitive immigration, currency, fiscal and taxation regimes. In addition, there are no restrictions on foreign shareholding, and the freedom of movement, entry and exit of capital is protected by the Basic Law.” Hui said that the COVID-19 pandemic has disrupted global supply chains. Amid the changing international situation, Hong Kong needs to leverage its strengths to accelerate collaboration with the Mainland and overseas.

Referring to the Policy Statement issued in late March this year, Hui said that the attractiveness of Hong Kong to global family offices is far beyond its role as an investment and financing centre. “To give an example, we held the ‘Wealth for Good in Hong Kong' summit in March to showcase Hong Kong's diverse advantages to decision makers of global family offices.” In his view, the Policy Statement clearly explained the full range of services that Hong Kong can provide to global family offices and asset owners, including those that serve the emerging new generation of family decision-makers as they pursue positive impacts.

Profits tax concessions and setting up of specialized network

In Hui's view, the eight measures outlined in the Policy Statement cover all aspects. He stressed that the authorities are pushing forward the various measures holistically. For example, the Legislative Council on 10 May passed a bill on providing profits tax concessions for family-owned investment holding vehicles (FIHVs) managed by eligible single-family offices (ESFOs) in Hong Kong. The Government will also provide HKD100 million to InvestHK in the next three years to strengthen its global promotional efforts to attract more family offices to Hong Kong.

“At the same time, the relevant team on 12 June launched the new Network of Family Office Service Providers (the network), with members coming from institutions that provide a full range of services to family offices. The network will provide a two-way channel for communication between the Government and the industry, and promote Hong Kong through the industry's global network.” Hui added.

Advantages of Greater Bay Area and tapping into development opportunities

According to a Hong Kong Financial Services Development Council report, the average value of assets under management of the family offices it interviewed reached RMB29.7 billion. Hui is certain that attracting more family offices to Hong Kong will help exert a huge multiplier effect, bringing huge funds into Hong Kong's initial public offering market, venture capital and private philanthropy, which will benefit Hong Kong's overall economy.

Hong Kong's asset and wealth management business at end-2021 amounted to HKD35.5 trillion. Hui said that 65% of the funds came from non-Hong Kong investors, which fully shows that Hong Kong has the strength to become the preferred asset and wealth management hub in Asia. He said that according to industry statistics, Hong Kong is also the largest hedge fund centre and cross-border wealth management centre in Asia. The “14th Five-Year” Plan clearly supports Hong Kong in its efforts to enhance its status as an international financial centre and strengthen its functions as a global offshore RMB business hub, an international asset management centre and a risk management centre. “Hong Kong must be able to play a unique role as a bridge and provide huge investment opportunities.”

KPMG

Choose the Location for a Family Office Based on Personal Needs

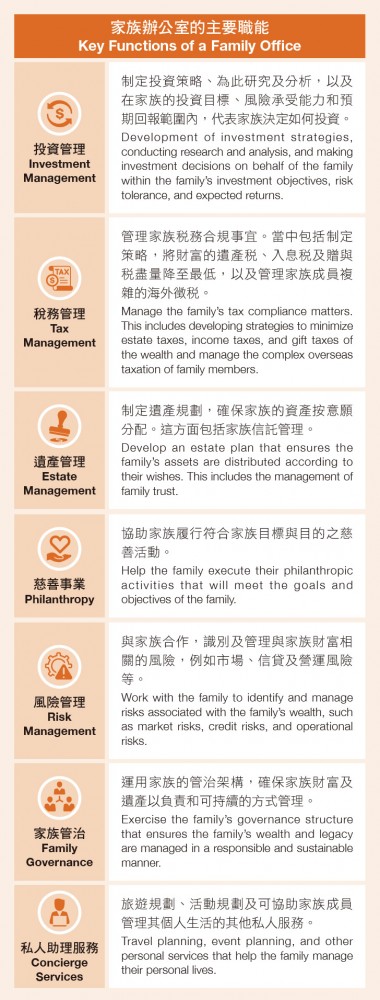

What is a family office? There is no clear or standard definition for family office. The scope of services provided by family office are highly personalized to fit the specific needs of a family and they will expand or change as the family reach different stages of life. Having said that, one of the key functions of family office is to manage the family's wealth and offer comprehensive financial services to the family. Over time, a family office can help wealthy families preserve their legacy for future generations.

One of the key functions of a family office is investment management and, as global financial centers, Hong Kong and Singapore have attracted numerous wealthy families to set up family offices there. Other factors which have contributed to Hong Kong's and Singapore's success as family office hubs includes the mature and stable regulatory environment, simple and favorable tax environment, political stability and strong rule of law, skilled talent pool of experienced professionals in the financial service industry, and access to investment opportunities and markets.

Government policies in two places

In Asia, both Hong Kong and Singapore governments have introduced policies to promote the family office industries.

Singapore has actively also promoted itself as a hub for family offices with the provision of tax incentives and investments in its wealth management industry over the past few years. As of the end of 2021, there was an estimate of 700 single family offices in Singapore which is up sevenfold from 2017. In March this year, Singapore has updated the qualifying requirement for the Global Immigration Program to attract “high-quality” investors to Singapore.

Singapore has actively also promoted itself as a hub for family offices with the provision of tax incentives and investments in its wealth management industry over the past few years. As of the end of 2021, there was an estimate of 700 single family offices in Singapore which is up sevenfold from 2017. In March this year, Singapore has updated the qualifying requirement for the Global Immigration Program to attract “high-quality” investors to Singapore.

Hong Kong also aims to attract 200 new family offices by 2025. To help achieve this, the government has introduced a number of policies and initiatives. On 10 May 2023, Hong Kong passed the Family Office tax regime where a family's investment profits from qualified assets can be exempted from Hong Kong profits tax provided certain conditions. These conditions include but not limited to the family office managing specified assets of HKD240 million and employment of two qualified full-time employees. To benefit from the regime, prior approval is not required. Some families have already positioned themselves to benefit from this tax regime and have also leveraged the Top Talent Pass Scheme and the Quality Migrant Admission Scheme to seek top global talent to work for their family offices. Further along the pipeline, the Hong Kong government announced in its 2023-24 budget speech that they are planning to re-introduce the Hong Kong Capital Investment Entrant Scheme (Hong Kong's investment immigration programme) to attract high net worth families to Hong Kong. These initiatives along with Hong Kong being one of the largest private equity and venture capital market in Asia, ranked top 3 in funds raised for IPO for nine out of the past ten years and its close proximity to the Chinese market make Hong Kong an attractive place for family offices to be located.

Consider personal needs

Every family is different and families who would like to set up family offices will need to assess their needs to determine the functions of their family office and its location. We have seen family offices in all shapes and sizes and families having a family office in both Hong Kong and Singapore to provide different functions is not uncommon. Due to the unique features of family office and it is still at the development stage in Asia, if you are considering setting up one for your family, it is advisable to engage consultants with relevant specialist skills to support you in the journey.

Article Contributor: Karmen Yeung, National Head of Private Enterprise at KPMG China